As students head back to campus this fall, this month’s chart reveals something fascinating: how we think about debt changes dramatically based on whether we’re carrying it ourselves.

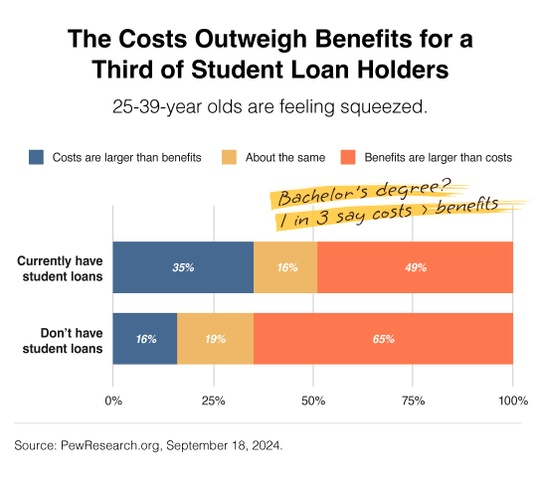

About one-third of student loan holders ages 25 to 39 say their bachelor’s degree wasn’t worth the lifetime financial costs, compared to just 16 percent of college graduates without outstanding debt. That 19-percentage-point gap tells us something important about the psychology of debt.

Debt on the Brain

When you’re making monthly payments, it’s natural to question whether it was worth it. Student loan holders face a constant reminder of their education’s cost through monthly payments that can stretch for decades. Those without debt have moved on mentally, allowing them to appreciate the benefits without the ongoing financial reminder.

The Present Bias Effect

There’s a psychological reason this happens: we naturally overvalue immediate costs versus future benefits. Research shows that carrying debt creates what psychologists call “present bias”—the monthly payment feels more real and immediate than any career opportunities that the degree has already unlocked. This also explains why it can feel difficult to increase one’s retirement plan contributions—the reduced paycheck today feels more painful than the future financial security you’re working toward. It’s human nature to feel immediate costs more intensely than long-term gains.

Debt Reframed

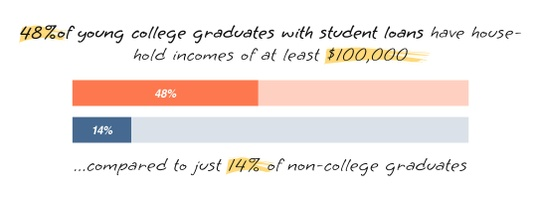

In the case of student loan debt, you’re essentially trading a present financial burden for future opportunities. When someone takes on student loans, they’re investing in a hoped-for future; and the data suggests this often pays off—48 percent of young college graduates with student loans have household incomes of at least $100,000, compared to just 14 percent of non-college graduates. The key question isn’t whether debt feels burdensome today—it often does—but whether it creates lasting value that justifies the temporary sacrifice.

Final Thoughts

Carrying student debt can cloud our judgment about past decisions. When evaluating major financial choices, remember that your future self will likely view the decision more positively than your current self, who is making the payments.

Azaz Mehmood, AAMS™

azaz.mehmood@crescentpw.com

219-810-6510

Indianapolis Office,

Crescent Private Wealth

Wealth Advisor

http://www.crescentpw.com