Stocks ended last week modestly lower after a volatile stretch driven by economic data releases, geopolitical headlines, and renewed Federal Reserve uncertainty. Despite intraday swings, markets largely digested the noise and finished the week near flat.

The Numbers

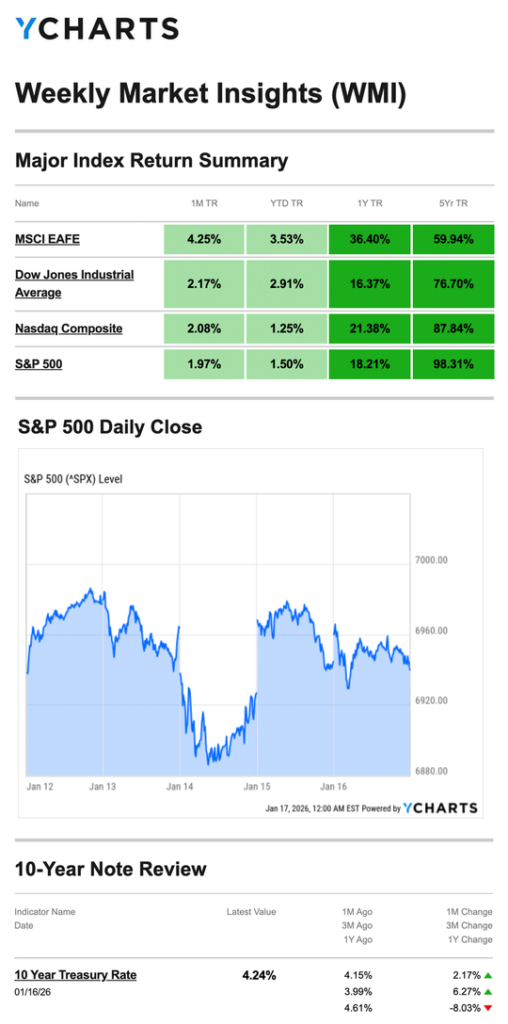

- S&P 500: −0.38%

- Nasdaq: −0.66%

- Dow Jones Industrial Average: −0.29%

- MSCI EAFE: +1.41%

U.S. equities struggled for direction as investors weighed inflation data, policy headlines, and earnings results. International markets outperformed as overseas sentiment remained relatively stable.

Source: YCharts.com, January 17, 2026. Weekly performance is measured from Monday, January 12, to Friday, January 16. TR = total return for the index, which includes any dividends and cash distributions during the period. Treasury note yield is expressed in basis points.

What Happened

Early Week: Volatility Returns

Markets opened lower after reports surfaced that the Department of Justice had launched a criminal investigation involving Federal Reserve Chair Jerome Powell. The headline injected uncertainty early in the week and pressured equities across sectors. A coordinated statement from global central bankers on Tuesday helped calm markets and reduce volatility.

Mid-Week: Inflation and Policy Headlines

Financial stocks came under pressure after the White House proposed a temporary 10% cap on credit card interest rates. Meanwhile, inflation data showed headline CPI in line with expectations while core inflation came in slightly cooler—news that investors viewed favorably.

Despite solid retail sales and wholesale inflation data for November, geopolitical tensions and weaker-than-expected fourth-quarter earnings from select financial institutions weighed on sentiment midweek.

Late Week: Partial Rebound

Chipmakers and banks led a rebound later in the week, helping markets recover most of their earlier losses. Stocks opened higher Friday before slipping again after the president walked back comments regarding a preferred candidate for the next Fed Chair—raising concerns about future monetary policy flexibility.

Fed Drama

Tensions between the White House and the Federal Reserve escalated following the Justice Department’s indictment of Chair Powell. Known for his measured approach, Powell responded with an unusually assertive public statement over the weekend.

By week’s end, markets appeared to look past the Fed-related headlines as attention shifted back toward economic data and earnings.

What We’re Watching

Policy Stability

Markets are increasingly sensitive to signals around Federal Reserve independence and future rate policy. Any perception of political pressure could amplify volatility.

Inflation Trajectory

Cooling core inflation remains supportive for markets, but investors will be watching closely for confirmation that price pressures are continuing to ease.

* indicates publication of a report delayed by the government shutdown in October and November

Source: Investors Business Daily – Econoday economic calendar; January 9, 2026. The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to provide accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

As always, if you have any questions about your portfolio or want to discuss your strategy, please don’t hesitate to reach out.

Crescent Private Wealth

Weekly Market Insights

Talk To Us!

Footnotes And Sources

1 .WSJ.com, January 16, 2026

2. Investing.com, January 16, 2026

3. CNBC.com, January 12, 2026

4. WSJ.com, January 12, 2026

5. CNBC.com, December 31, 2025

6. CDC.gov, August 25, 2025

7. CNBC.com, January 16, 2026