Markets finished a short but eventful week slightly lower as geopolitical tensions and renewed tariff rhetoric pressured sentiment early on. As the week progressed, constructive economic data helped stabilize markets and limit losses.

The Numbers

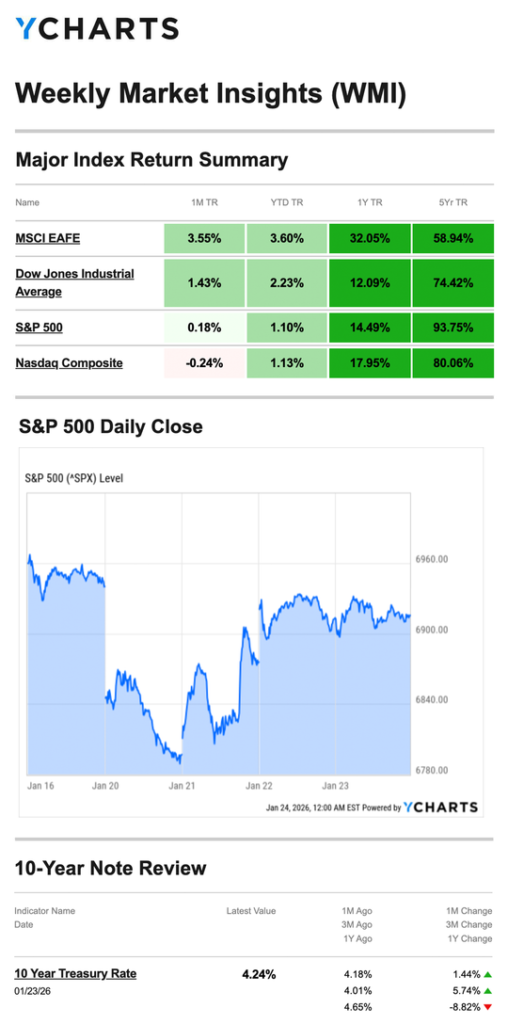

- S&P 500: −0.35%

- Nasdaq: −0.06%

- Dow Jones Industrial Average: −0.53%

- MSCI EAFE: +0.91%

U.S. equities slipped modestly, while developed international markets outperformed despite global headline risk.

Source: YCharts.com, January 24, 2026. Weekly performance is measured from Friday, January 16, to Friday, January 23. TR = total return for the index, which includes any dividends and cash distributions during the period. Treasury note yield is expressed in basis points.

What Happened

Early Week: Tariff Talk

Markets opened lower Tuesday after the White House threatened new tariffs on European Union nations following an international dispute involving Greenland. The S&P 500 and Nasdaq fell more than 2% intraday, with the Dow also under pressure.

Mid-Week: Rhetoric Cools

Sentiment improved Wednesday after U.S. officials signaled a more diplomatic approach toward Greenland. By the close, the White House walked back its tariff threats and announced progress toward a negotiated framework, easing investor concerns.

Late Week: Economic Support

On Thursday, markets accelerated higher following a modest upward revision to third-quarter GDP and lower-than-expected weekly jobless claims—signals that economic momentum remains intact.

Stocks moved sideways Friday as investors looked ahead to a heavy earnings calendar and the first Federal Reserve meeting of 2026.

Eye-Catching Small Caps

For 14 consecutive trading sessions through Thursday, January 22, small-cap stocks outperformed large caps, with the Russell 2000 beating the S&P 500—an occurrence not seen since May 1996. The streak ended Friday.

Historically, small caps tend to outperform when interest rates are falling. However, the 10-year Treasury yield has been trending higher since late October, creating a more challenging backdrop for sustained small-cap leadership.

What We’re Watching

Geopolitical Risk vs. Economic Reality

Markets continue to react sharply to geopolitical headlines, but economic fundamentals—growth, employment, and consumer resilience—remain supportive.

Interest Rates and Leadership

Rising long-term yields may influence which segments of the market lead in the months ahead, reinforcing the importance of diversification.

This Week’s Critical Data

- Wednesday: Federal Reserve Interest Rate Decision; Chair Powell Press Conference

- Friday: Producer Price Index (PPI) – December

These releases will shape expectations around inflation trends and the Fed’s policy path early in 2026.

* indicates publication of a report delayed by the government shutdown in October and November

Source: Investors Business Daily – Econoday economic calendar; January 23, 2026. Forecasts are subject to revision and may not materialize.

As always, if you have any questions about your portfolio or want to discuss your strategy, please don’t hesitate to reach out.

Crescent Private Wealth

Weekly Market Insights

Talk To Us!

Footnotes And Sources

WSJ.com, January 23, 2026

Investing.com, January 23, 2026

CNBC.com, January 20, 2026

CNBC.com, January 21, 2026

WSJ.com, January 22, 2026

CNBC.com, January 23, 2026

WSJ.com, January 22, 2026

IRS.gov, July 18, 2025

Cleveland Clinic, August 25, 2025