Stocks trended lower last week amid signs of year-end profit-taking and some sour investor sentiment over the Fed meeting minutes.

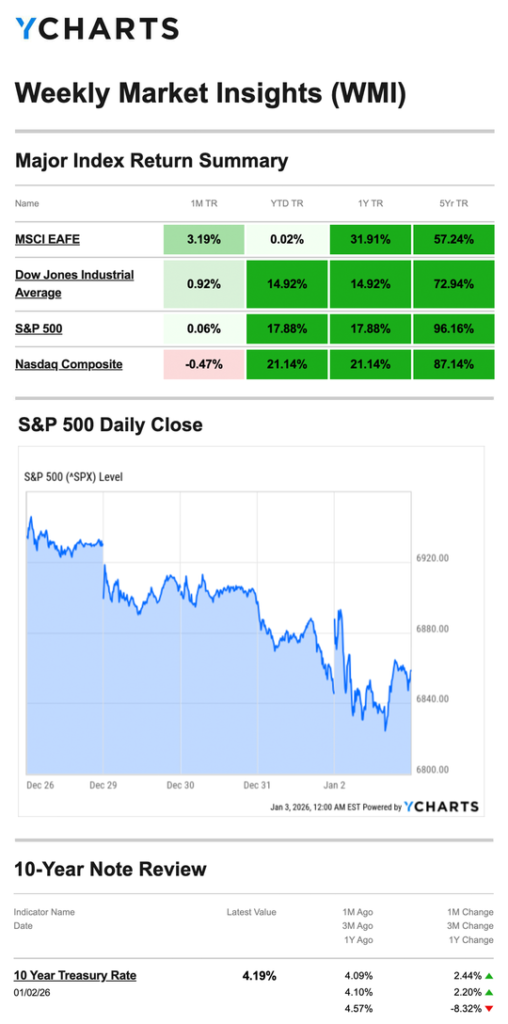

The Standard & Poor’s 500 Index fell 1.03 percent, while the Nasdaq Composite Index lost 1.52 percent. The Dow Jones Industrial Average slid 0.67 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, ticked up 0.31 percent.1,2

Santa Rally, Interrupted

Stocks opened lower to start the shortened holiday week with tech shares under pressure. Markets then moved sideways, but came under pressure after minutes from the December Federal Reserve meeting were released. Investors digested the details, which showed members remained divided.3,4

Stocks recovered some ground on the first trading day of 2026. The tech sector was mixed, with AI chip stocks pushing higher, while other areas of technology, especially software companies, declined. Overall, the S&P 500 and Dow Industrials logged gains to kick off the new year, which helped pair losses from earlier in the week.5,6

It remains to be seen whether the “Santa Claus rally”, which ends Monday, January 5, will materialize. The Santa period is the last five trading days of December through the first two trading days of the new year.

Source: YCharts.com, January 3, 2026. Weekly performance is measured from Friday, December 26, to Friday, January 2. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Focus on the Fed

There was little economic data last week, leaving investors to focus mostly on the minutes from the Fed’s December meeting. The minutes, released Tuesday, revealed a divided Federal Open Market Committee regarding short-term interest rates. The news unsettled investors a bit, which led to some selling pressure.7

A divided Fed has been a persistent theme during the second half of 2025, and investors will closely watch in 2026 to see whether the Fed’s outlook may change with the appointment of a new Fed Chair.

This Week: Key Economic Data

Monday: Institute of Supply Management (ISM) Manufacturing Index. Auto Sales.

Tuesday: Richmond Fed President Tom Barkin speaks. Purchasing Managers Index (PMI)—Services.

Wednesday: ADP Employment Report. Job Openings* (Nov). Factory Orders* (Oct). Institute of Supply Management (ISM) Services Index. Fed Vice Chair for Supervision Michelle Bowman speaks.

Thursday: Weekly Jobless Claims. Trade Deficit* (Oct). Productivity* (Q3). Consumer Credit (Nov).

Friday: Employment Report. Housing Starts* (Oct). Consumer Sentiment.

* indicates publication of a report delayed by the government shutdown in October and November

Source: Investors Business Daily – Econoday economic calendar; January 2, 2026. The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to provide accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

As always, if you have any questions about your portfolio or want to discuss your strategy, please don’t hesitate to reach out.

Crescent Private Wealth

Weekly Market Insights

Talk To Us!

Footnotes And Sources

1 .WSJ.com, January 2, 2026

2. Investing.com, January 2, 2026

3. CNBC.com, December 29, 2025

4. WSJ.com, December 30, 2025

5. CNBC.com, December 31, 2025

6. CNBC.com, January 2, 2026

7. CNBC.com, December 30, 2025