Markets rallied last week, with the S&P 500 up 1.57% and the Dow posting its best week in months, gaining 2.32%. Here’s what drove the move and what to watch this week.

The Numbers

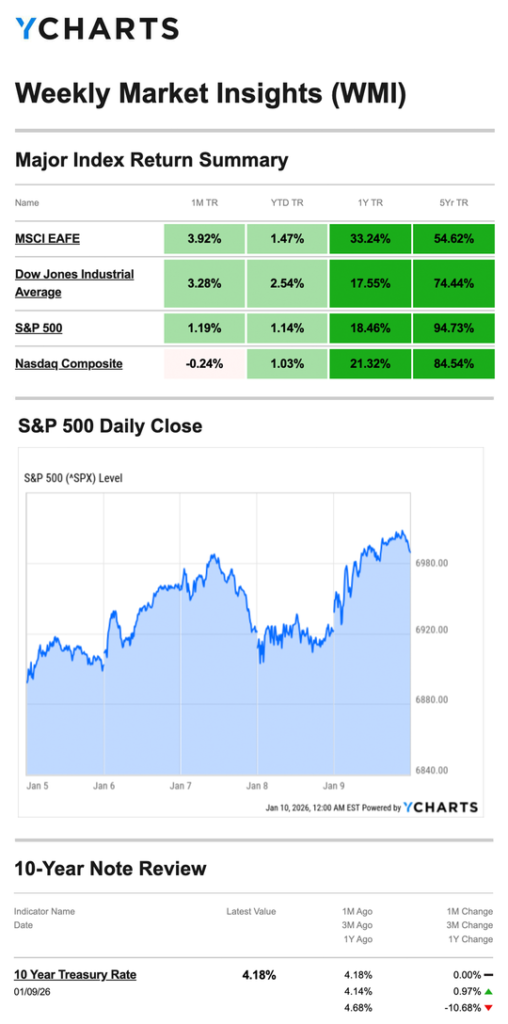

- S&P 500: +1.57%

- Nasdaq: +1.88%

- Dow: +2.32%

- MSCI EAFE: +1.41%

Strong performance across the board, driven by a mix of bullish sentiment, rotating sector momentum, and a softer-than-expected jobs report that investors interpreted as Fed-friendly.

Source: YCharts.com, January 10, 2026. Weekly performance is measured from Monday, January 5, to Friday, January 9. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

What Happened

Early Week: Rally Momentum

The Dow finally delivered its “Santa Rally,” gaining 1.1% over the seven-session period. By Tuesday, AI chip stocks drove all three indexes higher. The Dow crossed 49,000 for the first time, with both the S&P 500 and Dow hitting record closes.

Mid-Week: Sector Rotation

Then investors started rotating out of tech into cyclicals—industrials, defense, financials. Defense stocks got a boost from news of a proposed $1.5 trillion defense budget for 2027. The Dow, weighted more toward these sectors, pulled ahead.

Friday: Jobs Report

December employment showed 50,000 net new jobs (below 73,000 expected). Unemployment ticked down to 4.4%.

Context: Full-year job growth averaged just 49,000 per month—the slowest pace in 22 years. Federal job cuts (277,000 positions eliminated) drove much of the weakness.

Markets rallied on this news. Why? Weaker job growth gives the Fed flexibility on rates at their January meeting.

What We’re Watching

Sector Rotation: The move from tech to cyclicals could signal a shift in market leadership. For diversified portfolios, this rotation validates the structure—you’re not overconcentrated in any single sector.

Labor Market: Job growth at 49,000 per month is historically weak. The Fed will watch whether this is an orderly slowdown or something accelerating.

This Week’s Critical Data: CPI drops Tuesday. That’s the report that matters. If inflation comes in hot, last week’s rally reverses quickly.

* indicates publication of a report delayed by the government shutdown in October and November

Source: Investors Business Daily – Econoday economic calendar; January 9, 2026. The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to provide accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

As always, if you have any questions about your portfolio or want to discuss your strategy, please don’t hesitate to reach out.

Crescent Private Wealth

Weekly Market Insights

Talk To Us!

Footnotes And Sources

1 .WSJ.com, January 2, 2026

2. Investing.com, January 2, 2026

3. CNBC.com, December 29, 2025

4. WSJ.com, December 30, 2025

5. CNBC.com, December 31, 2025

6. CNBC.com, January 2, 2026

7. CNBC.com, December 30, 2025